tax incentives for electric cars in california

Purchasing an electric car can give you a tax credit starting at 2500. More than 9000 potentially available with California EV rebates and EV tax credits.

The Electric Vehicle Rebate In California And Other Incentives Coltura Moving Beyond Gasoline

500 EV Tax Credit.

. If at least 50 of the battery components in your EV are made in the US. Electric Vehicle EV owners under Colton Electric service territory are eligible to receive a 1000 rebate. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

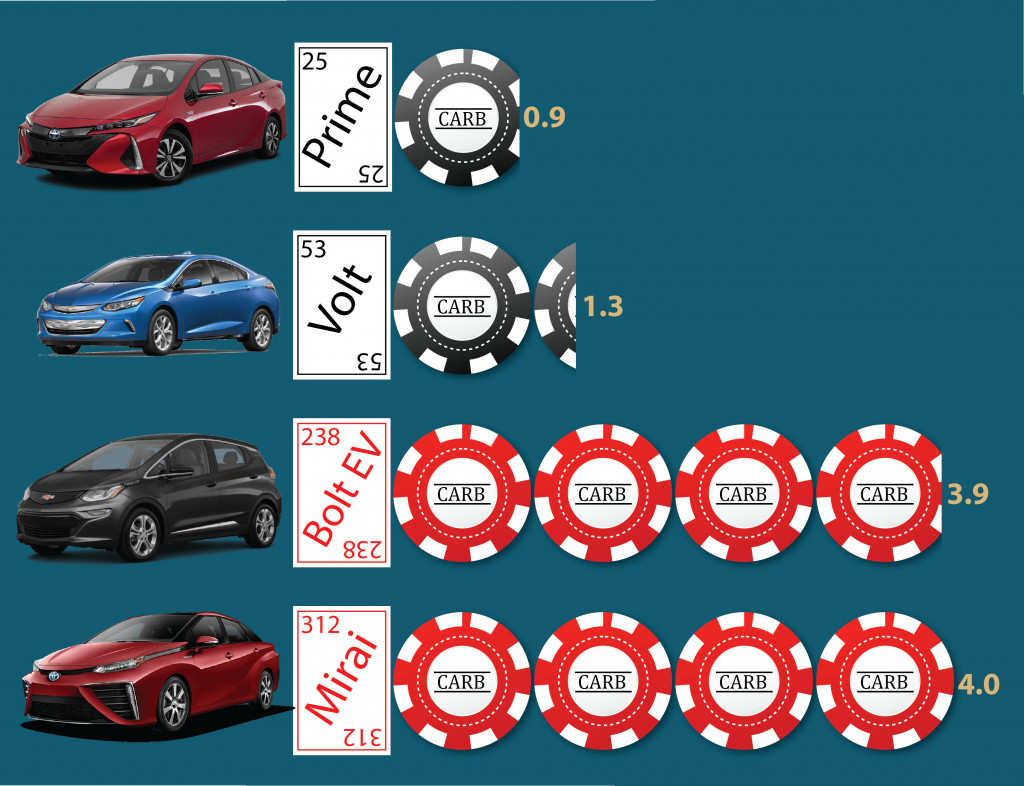

Plug-in hybrid electric vehicles are eligible for a 3000 tax credit only for individuals making 50000 or less or married couples making 75000 or less. Small neighborhood electric vehicles do not qualify for this credit but. State leaders have spent years trying to encourage Californians to buy electric cars offering subsidies worth up to 5000 and other incentives including access to high-occupancy-vehicle lanes.

Federal income tax credit up to 7500Currently 7500 is the maximum amount available to buyers of new fully electric or plug-in hybrid cars leasing only qualifies for the leasing company. State andor local incentives may also apply. If you lease the credit goes to the manufacturer.

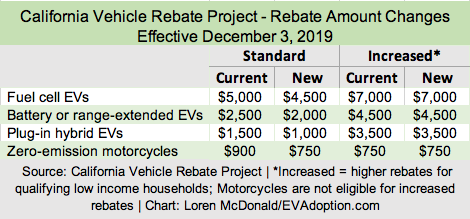

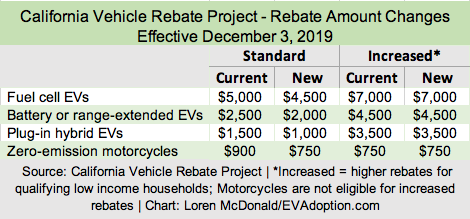

Trying to get specific information from the IRS via the phone is impossible. 4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles PHEVs and 750 for zero emission motorcycles. Clean Vehicle Rebate Program CVRP Get up to 7000 to purchase or lease a new plug-in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV.

For instance in my home state of Vermont state incentives tax credits are offered for electrified vehicles. You can search for the vehicle and then apply for the rebate. CALeVIP Alameda County Incentive Project.

The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive. 45 rows Federal Tax Credit As of Jan 1 2020 Eligible for CVRP California CVRP Rebate As of Dec 3 2019 Range miles MSRP MSRP - Fed Calif. Customers enrolled in the low-income program are eligible to receive an increase rebate of 1500.

EV vans trucks and SUVs with an MSRP of up to 80000 qualify increase from before The electric car tax credit is only available to individuals with a gross. Tesla Model S Long Range. If your EV was made in the US with a union workforce.

7000 for FCEVs 4500 for EVs 3500 for PHEVs. That being said California is giving credits to EV owners for an electric car home charger. Avoid the bothersome traffic jams of Los Angeles or Orange County by simply applying to get your HOV sticker.

Find every electric car rebate through our EV incentives tool. Here are a few highlightsfind them all in the incentives search. A substantial tax credit for battery-electric hydrogen fuel cell and plug-in hybrid electric vehicles ranging from 2500-7500 may be available depending on the battery capacity.

For low to moderate-low-income to moderate-income buyers. Tesla Model 3 Long Range. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. If you purchase or lease a plug-in hybrid and live in California you could also be eligible to receive a 1000 standard rebate. Many utilities and local areas also offer incentives.

Some other notable changes include. The incentives go up as high as 12500 on new cars and up to 4000 on used electric vehicles. And potentially even more importantly these tax credits will be refundable.

All-electric cars are eligible for a 4000 tax credit for the same group. CVRP enables a purchaser or lessee of an eligible vehicle to apply for a CVRP rebate of up to 7000 for fuel-cell electric vehicles FCEVs up to 4500 for all-battery electric vehicles BEVs up to 3500 for plug-in hybrid electric light-duty vehicles PHEVs and up to 750 for zero-emission motorcycles ZEMs. CVRP offers vehicle rebates on a first-come first-served basis and helps get the cleanest vehicles on the road in California by providing consumer rebates to reduce the initial cost of advanced.

How Does the CVRP Work. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Entities that purchase and install EV chargers are eligible to receive up to 3500 or 75 of project costs whichever is less.

Tesla Model S Performance. The credit is for the purchase of a new plug-in electric vehicle with at least 5kw hours of capacity. For those that qualify Besides the generous credit for a LEVEL 2 home charger electric car owners can also qualify for a free HOV sticker.

Battery electric vehicles get a standard 2000 incentive and hydrogen fuel-cell vehicles get a standard 4500 break. The credit is a deduction on your federal income tax return for the calendar year in which you purchased the car. Other tax credits are available if the battery size is 5kWh with a cap of 7500 credit if.

All electric and plug-in hybrid cars purchased new in 2010 or after may be eligible for a federal income tax credit up to 7500. The credit amount will vary based on the capacity of the battery used to power the vehicle. 4500 EV Tax Credit.

CALeVIP Alameda County Incentive Project provides rebates to entities toward the purchase and installation of EV chargers. Colton Electric Utility - Used Electric Vehicle Rebate.

Electric Car Industry Group Says Californians Have Now Purchased 500 000 Evs Ars Technica

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

The Electric Vehicle Rebate In California And Other Incentives Coltura Moving Beyond Gasoline

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Southern California Edison Incentives

13 Evs No Longer Eligible For California S Ev Rebate Changes Effective December 3 Evadoption

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

13 Evs No Longer Eligible For California S Ev Rebate Changes Effective December 3 Evadoption

Why Are So Many Electric Cars Still Only Sold In California

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Car Use By Country Wikiwand

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Electric Vehicle Tax Credits What You Need To Know Edmunds

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Ev Incentives Ev Savings Calculator Pg E

Southern California Edison Sce Electric Vehicle Incentives And Rebates In 2021 Stellar Solar